Overview

The Tax Commissioner is responsible for the registration of motor vehicles and the collection of all registration fees, taxes and penalties specified by Georgia Law. Title Ad Valorem Taxes or Ad Valorem taxes, if due, are collected when the vehicle is registered.

All motor vehicles and trailers 1986 and newer must be titled (not applicable to boat and utility trailers weighing less than 2,000 lbs.)

All 1963 and newer Mobile Homes require a title.

Vehicles purchased from an individual or business (not a dealership) must be registered within 7 days of the purchase date.

Vehicles purchased from a dealership or individual must be titled within 30 days of the purchase date or late fees and penalties will apply.

Individuals moving to Georgia have 30 calendar days after establishing their residency to register their vehicles. However, if your out-of-state registration is not current, you should come to the Forsyth County Tax Commissioner’s office as soon as possible with all required documentation to obtain a Georgia title and registration.

Online Service Center for Tags - Click here

- Renew Tags

- Cancel Registration

- Change Address

- Insurance Fine

- TAVT Estimator

- Insurance Status

- Title Status

- Pre Apply for Tag and Title

Renewal Options

- Online at DRIVES

e-Services

- Mail your renewal to 1092 Tribble Gap Rd., Cumming, GA 30040

- Drive-through available at 1092 Tribble Gap Rd, Cumming, GA 30040

- Visit one of our two locations. 1092 Tribble Gap Rd, Cumming, GA 30040 and 1950 Sharon Road, Cumming, GA 30041

- Kiosk - In a hurry, stop by any participating Kiosk location in the State of Georgia for your renewal.

- Drop box at each office location:

- 1092 Tribble Gap Road, Cumming, GA 30040

- 1950 Sharon Road, Cumming, GA 30041

***A valid Georgia driver's license or Georgia Identification card is required as personal identification, when you title, register or make other changes to your account. Georgia Department of Revenue Motor Vehicle Division uses the Georgia driver's license number as an account number so that all vehicles owned or leased by an individual can be consolidated in one account.

**An important note to remember when titling a vehicle - motor vehicles are covered under the privacy act in Georgia and no one but the registered owner can process transactions for the vehicle. If the vehicle is in a spouse’s name, you will not be able to process transactions on that vehicle unless you have a limited Power of Attorney.***

Title Ad Valorem Tax

Effective Friday, March 1, 2013, House Bill 386 removed both sales-tax and annual ad valorem taxes from vehicles purchased 03/01/13 and thereafter, and replaced them with a single, one-time Title Ad Valorem Tax (“TAVT”).

VEHICLES PURCHASED ON OR AFTER MARCH 1, 2013:

If you purchased a vehicle on or after March 1, 2013; you will pay the "TAVT" to the tag office in your County of residence at the time of title application & registration. "TAVT" must be paid prior to the issuance of a Georgia title & license plate.

"TAVT" is not an annual tax. It is due from the purchaser each time the vehicle is purchased & titled.

For more information regarding the Title Ad Valorem Tax, please call us at (770) 781-2112; email auto@forsythco.com. or visit the Georgia Department of Revenue at https://eservices.drives.ga.gov/

OTHER IMPORTANT INFORMATION:

A vehicle purchased prior to 03/01/2013 currently subject to annual ad valorem tax will continue to be taxed as such until the vehicle is sold and re-titled.

All other existing annual vehicle registration requirements, including annual tag renewal fees, decals, and emissions tests (if applicable), remain in effect for all vehicles regardless of purchase date.

Newly Acquired Vehicles

FOR PRIVATE SALES:

Both registration and title for a newly purchased motor vehicle from a source other than a registered dealer must be applied for at the new owner's county tag office no later than seven (7) days after the date of purchase. The seven (7) day requirement is contained in Georgia Law (O.C.G.A. 40-2-29).

If the certificate of title is in the possession of a security interest or lien holder at the time of application, the county tag office may issue a temporary license plate, valid for thirty (30) days. If the transferor does not provide a title to the transferee within five (5) days prior to the expiration of the initial thirty (30) day temporary license plate, the county tag office may issue a single thirty (30) day extension of the temporary license plate. (O.C.G.A. 40-2-29).

PURCHASED FROM REGISTERED DEALER:

The owner of a motor vehicle purchased from a registered dealer will be issued a dealer temporary license plate from the registered dealer at the time of purchase. The temporary license plate is valid for forty-five (45) days.

Only a temporary license plate issued by a registered dealer or the county tag office is considered valid. Any other type of temporary license plate ("Tag Applied For", etc.) is considered unlawful. Operation of a motor vehicle displaying a non-valid license plate or non-valid temporary license plate shall be punishable as a misdemeanor subject to fines.

New to Georgia

Vehicles new to Georgia must be titled and registered within thirty (30) days of the date Georgia residency is established. Out of state registrations expire thirty (30) days after your move to GA, regardless of the expiration date of the out of state registration. Only two exceptions apply - non-resident military personnel and full-time college students.

Individuals moving to Georgia have thirty (30) calendar days after establishing residency to title and register their vehicles.

Residents moving to Georgia will pay a one-time Title Ad Valorem Tax (TAVT) equaling 3% of vehicle value when applying for a Georgia title and registration. This reduced rate only applies to vehicles already titled and registered in the new resident’s name in their prior state and does not apply to new purchases. Vehicles registered beyond thirty (30) days from date of residency are subject to a $10 late title penalty, as well as a TAVT penalty of 10% of the principle TAVT due (an additional 1% will apply for each subsequent month past-due). To obtain a TAVT estimate for your vehicle, please visit the Georgia Department of Revenues online TAVT estimator here.

The following is a list of items you will need to bring to our office.

- The original out-of-state title issued in your name, OR,

- If you have moved into Georgia from another state and your lender or leasing company is holding your out-of-state title, you must complete and sign a Statement of Title Held by Lien Holder or Leasing Company (Form T-17) and submit it with your original valid out-of-state registration certificate in lieu of your title. Please note: If you are coming from Missouri, Kentucky, Montana, Maryland, New York, Michigan, Oklahoma, Minnesota or Wyoming you must have the title to register.

- If the vehicle is leased, you will also need a notarized power of attorney from the leasing company and the lease agreement (with the name and address of the leasing company).

- Title Application (MV-1) signed by all owners, or, for any owner(s) not present, an original notarized power of attorney (Form T-8) and a legible photocopy of the valid Georgia driver’s license or valid Georgia identification card.

- Current registration from the former state.

- Current Georgia insurance

- Current mileage of the vehicle(s)

- Current Georgia Emissions Inspection Certificate, if applicable.

- If any owner is not present, a legible photocopy of the valid Georgia driver’s license or valid Georgia identification card is required

- If you need information on how to obtain a Georgia driver’s license or Georgia identification card,click here.

PLEASE NOTE: Date of residency may be based on one or more of the following:

- Date of Georgia Driver’s License/ID Card issuance

- Closing date of home purchase

- Rental Agreement execution date

- Utility establishment of service date

Once your vehicle is registered in Georgia, you are required to renew your vehicle's registration by the vehicle's renewal deadline each year, which is the first registered owner’s birthday.

Vehicle Insurance

Insurance Requirements

Insurance cards are not an acceptable proof of insurance coverage for motor vehicle transactions at the Forsyth County tag office. Your insurance company is required to electronically transmit proof of insurance directly to the Georgia Department of Revenue (DOR) database.

Printed Proof of Insurance

An original 30-day insurance binder with an effective date that is less than 30 days may be accepted for the following reasons:

- A vehicle is purchased from an individual

- Tag was cancelled during the time period with no insurance. Tag reinstatement is requested.

- Owner has moved in from out of state

Fleet or Self-insured Policy

A Georgia Fleet insurance card with the words "Georgia Fleet" on it.

A Self-Insured insurance card and a Certificate of Self Insurance.

The card must be presented at the time of registration or renewal.

Lapse of Insurance, Suspensions and Waivers

A lapse in insurance occurs when a vehicle has not carried valid Georgia liability insurance coverage for a period of more than ten (10) days. Your insurance company reports the lapse to the Georgia Department of Revenue (DOR), and a notice of pending registration suspension is generated and mailed by the DOR. A lapse will result in $25 pending-suspension fee which must be paid within thirty (30) days. If the $25 pending-suspension fee is not paid by the due date, the registration will be suspended by the DOR. To reinstate the registration, the vehicle must have valid Georgia insurance coverage, the $25 pending-suspension fee plus a $60 reinstatement fee must be paid, as well as any other registration fees, ad valorem taxes or penalties due. Any additional lapses in coverage and/or suspensions will result in additional fines and penalties including cancellation of the vehicle's registration. It is advised that you cancel your registration before you cancel your insurance policy to avoid any suspensions or fees. Taxes must be current and there must not be any outstanding fees.

Pay insurance lapse fines at http://eservices.drives.ga.gov

Canceling Insurance

Before cancelling insurance on a vehicle, cancel the registration at http://eservices.drives.ga.gov First to avoid penalties. Registration must be canceled if the vehicle is:

- Sold or traded-in

- Registered in another state

- Repossessed, stolen, wrecked, salvaged by an insurance company, or junked

- Stored or rendered inoperable.

Cancelling the registration renders it inactive while maintaining the record. Registration can be reactivated at any time, provided insurance is restored and any outstanding taxes due are paid.

Drivers Licenses

Georgia driver's licenses and Georgia ID's are issued by the Georgia Department of Driver Services. Call

678-413-8400 or visit their website at https://dds.georgia.gov/ for more information.

Emissions Testing

For 2025 registrations, all 2001-2022 model year gasoline-powered cars or light trucks up to 8,500 lbs., (excluding diesels, and alternative fuel vehicles) must have a valid Georgia emissions inspection.

An emission inspection must be completed prior to submitting a vehicle renewal to receive a

registration decal. Visit http://www.cleanairforce.com/ for additional emission test

information

- Where to go - vehicles can be inspected at any emissions inspection station.

- Inspect early - It's best to get your vehicle inspected early, in the event repairs need to be made. An emissions inspection is valid for 12 months or for one registration renewal by the same owner.

- Providing proof of emissions Inspection - The emissions inspection station that completes the emissions testing is required to electronically submit the test results to the Georgia Department of Revenue motor vehicle database. If the emissions information is not in the database electronically, submit the original emissions certificate to the tag office.

If the Vehicle Does Not Pass the Emission Test

It is the owner’s responsibility to renew the vehicle’s registration by the due date to avoid paying tax and/or tag penalties.

A thirty (30) day extension can be issued with a failing emissions for a renewal.

If the vehicle does not pass the emissions test, the owner(s) should pay any ad valorem taxes due on the vehicle by the renewal due date to avoid paying a 10 percent ad valorem tax penalty.

Please note that if ad valorem taxes are paid on time, but the tag and/or decal cannot be renewed by the due date because of a failed emissions test, the state still assesses a tag penalty of $5.

Georgia’s Clean Air Force recommends having your vehicle inspected early in the event repairs need to be made.

For more information on emission testing, visit http://www.cleanairforce.com/

Senior Emission Waiver (Senior Exemption)

Senior Exemptions: If you are age 65 or older and are a registered owner of a vehicle 10 model years old or older, and if you drive less than 5,000 miles per year, you may be eligible for a senior exemption. Click Here for a copy of the Senior Exemption Application.

The Forsyth County Tax Commissioners office processes senior emissions waivers (exemptions) for Forsyth residents.

Out-of-Area Extensions

If you (or a family member) and your Georgia-registered vehicle are temporarily located outside the 13-county emissions testing area of Georgia due to school, military or business obligations, you may qualify for an Out-of-Area Extension.

Visit the Georgia Clean Air Force website at http://www.cleanairforce.com/ for applications and information.

Repair Waivers

To apply for a repair waiver, visit a Georgia Clean Air Force Center. Locations of these centers, along with general information and requirements, are available at the Georgia Clean Air Force website.

General Titling

Vehicles 1986 and newer require a title to transfer ownership. Transfer of ownership must be processed in the county which the new owner lives. (mobile home titles must be processed in the County in which mobile home is located.)

Salvage vehicles are not eligible for a Georgia title or registration until they have been rebuilt and passed inspection. For more information on salvage vehicles, visit the Georgia Department of Revenue website.

**An important note to remember when titling a vehicle - motor vehicles are covered under the privacy act in Georgia and only the registered owner can process transactions for the vehicle. If the vehicle is in a spouse's name, you will not be able to process transactions on that vehicle unless you have a limited Power of Attorney from them.***

Click here for the Limited Power of Attorney.

Register a Recently-Purchased Vehicle from a Dealership

When a vehicle is purchased from a dealership, the title must be applied for by the dealer before registration. Note: It is the sole responsibility of the dealership to collect and submit TAVT to the tag office and to submit title application.

.

All title work must be completed before a tag will be issued.

Dealerships may purchase a tag for the customer, but are not required to.

If a dealership submits the tag request with the title application electronically, the tag will be mailed to the customer directly from the Department of Revenue in Atlanta.

If the dealership did not purchase a tag on your behalf, you should receive a copy of the title receipt in the mail. You may go to drives eservices to purchase your tag or visit one of our two locations.

If you have not received a copy of the title receipt and it has been at least twenty-five (25) days since the date of your purchase, contact the dealer to determine the status of your title application.

Note: Under normal circumstances, the information provided below is required to register a vehicle. Other documentation may be required upon review of the paperwork.

You will need to bring the following items when visiting one of our offices:

- Valid Georgia driver's license or Georgia identification card

- Valid Georgia insurance

- Current Georgia emissions inspection, if applicable

- An original notarized power of attorney (Form T-8) from any owner who will not be present at the time of registration

- If the vehicle is leased, you must provide the original lease agreement that includes the names and addresses of the leasing company and the lessee(s)

Register a Recently-Purchased Vehicle from an Individual or Business

For a vehicle purchased from an individual or business, the new owner is required to apply for the title and registration. The new owner must title the vehicle within thirty (30) days. Registration must be completed within seven (7) days.

A registration can be issued along with the application for the Georgia title or after the application has been processed.

Note: Under normal circumstances, the information provided below is required to register a vehicle. Other documentation may be required upon review of the paperwork.

When the seller has provided a title properly signed over to you bring the following

items:

- Valid Georgia driver's license or Georgia identification card.

- Bill of Sale

- Original Certificate of Title

- Valid Georgia insurance

- Current Georgia emissions inspection, if applicable

- An original notarized power of attorney (Form T-8) from any owner who will not be present at the time of registration.

With a Lien

If you purchased your vehicle from an individual or business and the certificate of title is in the possession of a bank or other financial institution, you must still apply for the Georgia title and registration within seven business days. If you are financing the vehicle, the lien holder normally will submit the necessary documents to apply for your title. After the title application has been processed, the lien holder will send you a copy of the title receipt and you will need to visit a Forsyth County tag office to register your vehicle.

If you have purchased your vehicle from an individual or business and there is a lien involved and the bank or financial institution does not provide the title within the seven day period, then you will not be able to title or register the vehicle. In certain situations, you may be able to obtain a temporary operating permit.

Note: Under normal circumstances, the information provided below is required to obtain a temporary operating permit. Other documentation may be required upon review of the paperwork

When the certificate of title is in the possession of a bank or other financial institution bring the following items:

- Valid Georgia driver's license or Georgia identification card.

- Bill of Sale

- Copy of seller’s registration

- Valid Georgia Insurance

- Current Georgia Emissions Inspection, if applicable

- An original notarized power of attorney ( Form T-8) from any owner who will not be

present at the time of registration

- If the vehicle is leased, you must provide the original lease agreement that includes the names and addresses of the leasing company and the lessee(s)

- Want to know an estimate of the Title Tax prior to purchasing a vehicle?

Click here to be directed

to the Georgia Department of Revenue website for the TAVT calculator, you will need the VIN

of the vehicle for the estimate.

For information on how to obtain a Georgia driver’s license or Georgia identification card,

visit the Department of Drivers Services

website.

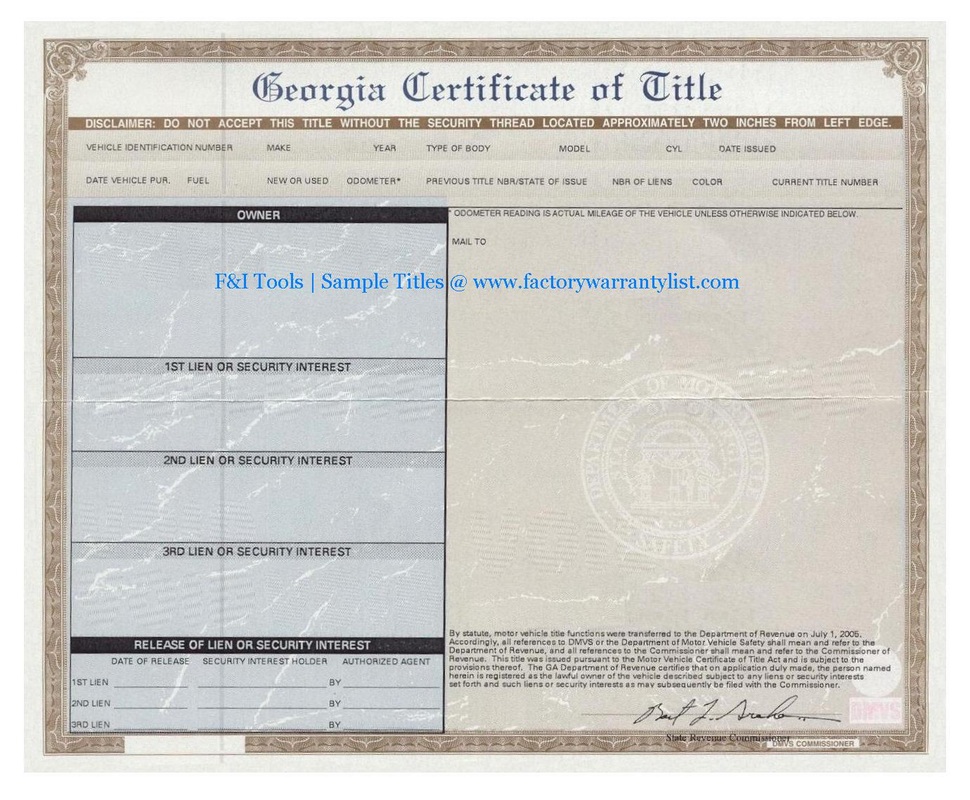

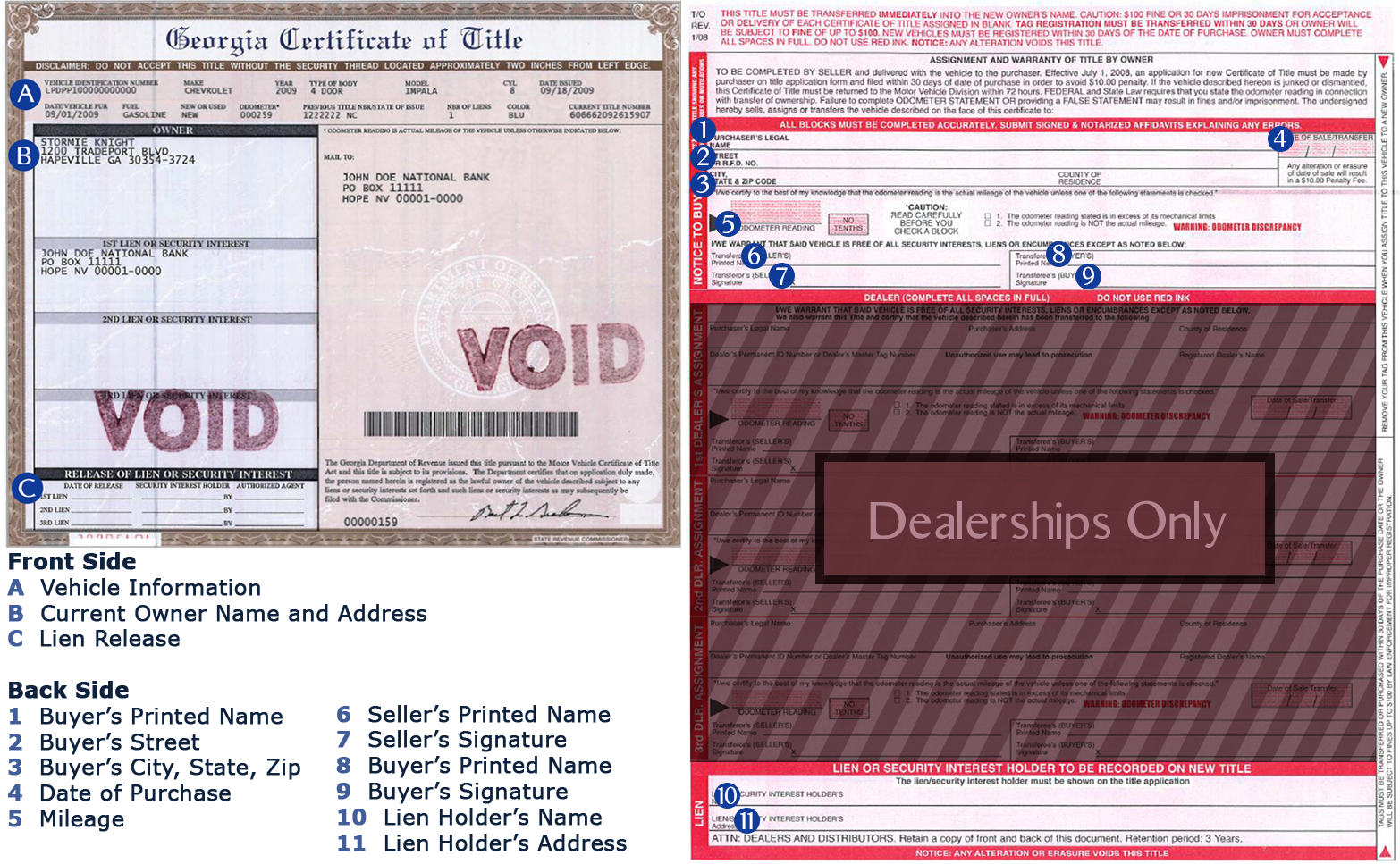

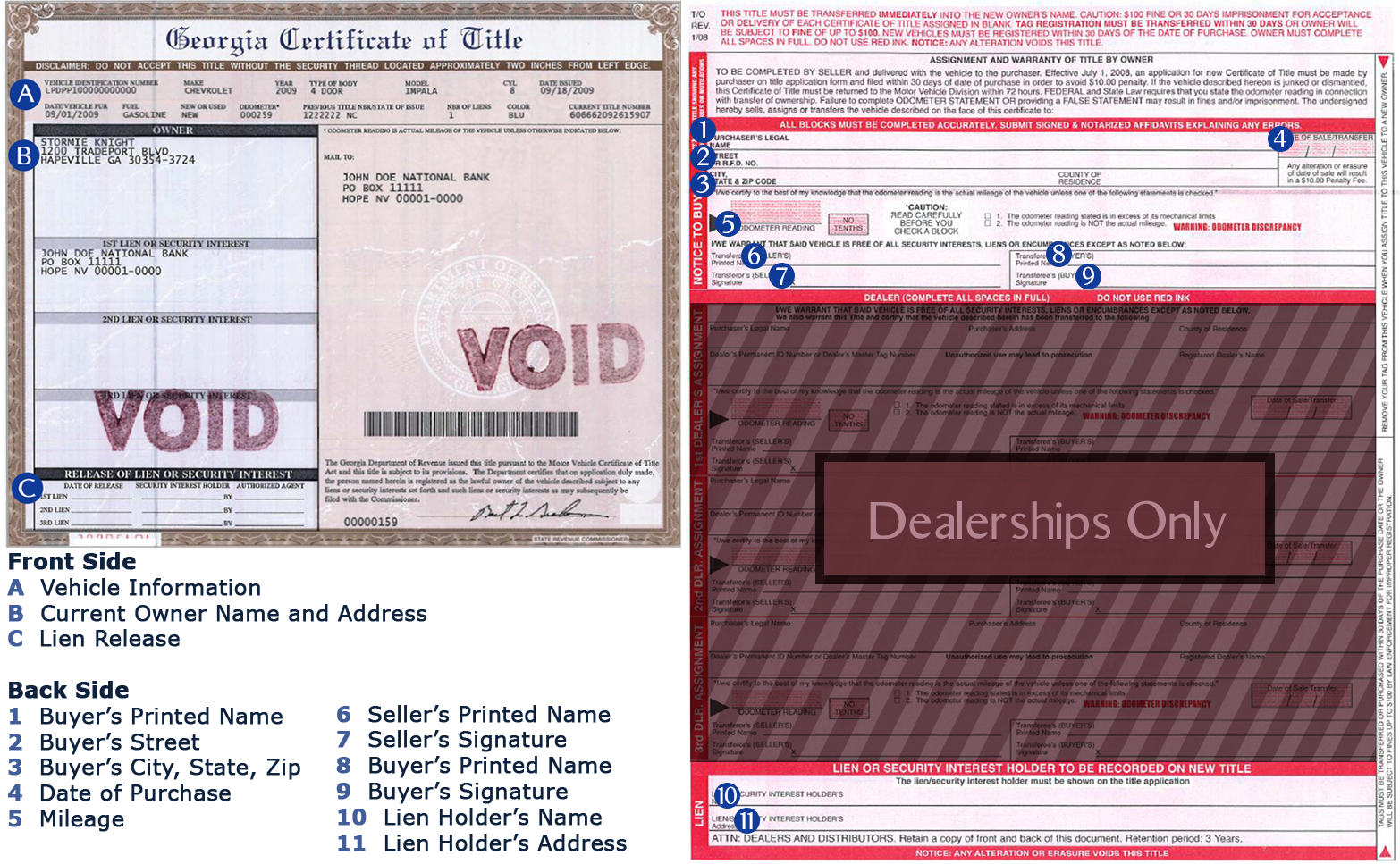

How Do I Fill Out The Title?

**An important note to remember when titling a vehicle - motor vehicles are covered under the privacy act in Georgia and no one but the registered owner can process transactions for the vehicle. If the vehicle is in a spouse's name, you will not be able to process transactions on that vehicle unless you have a limited Power of Attorney from them.***

Click here for the Limited Power of Attorney.

Read every title carefully!

Titles from other states will be designed differently, but the information required is often the same. Some out of state titles will need a notarized seller’s signature.

Erasures and whiteout will void a title. Mistakes may require extra forms to correct what someone wrote incorrectly. If you do not know what to write or do, call us or come into the office and our clerks can assist you.

Instructions for filling out a title:

- Look at the front of the title. Make sure any listed lien holders have filled in box

(c).

* If the lien has not been signed off, you will need a lien release from the

previous owner's lien holder.

- Flip the title over to the back.

- Make sure all owners on the front of the title have printed their names and signed

on lines (6) and (7).

- Print your full legal name (just like it is on your driver's license) on line (1).

- Print your current residential address on lines (2) and (3).

* If you have a different mailing address, you will write that on the title

application.

- Write the date you purchased the vehicle on line (4).

* If you make a mistake, any correction adds a $10.00 penalty.

- Write the current mileage on line (5).

* If you make a mistake, STOP. We have an affidavit to correct the problem, do

not mark through the mileage.

- Print your full legal name on line (8).

- Sign your name online (9).

- If you make payments on the vehicle, write the name and address of the

person/company to whom you are sending your payments on line (10) and (11).

** Please note that the highlighted section that states dealerships only, should not have an individual’s name in this section. If someone is selling you a vehicle, they cannot put your name in that section to transfer ownership. They will have to get the title processed into their name first. **

Initial Vehicle Registration

Newly acquired vehicles must be registered within 7 days. If purchased from an individual, the Title Ad Valorem Tax will be paid, and a tag will be issued with emissions and proof of insurance. Effective January 1, 2000, all Forsyth County residents must have an emission test done annually on their vehicle prior to purchasing their tag. Vehicles are exempt from the emission tests for the first three model years

Newly acquired vehicle purchased from a dealer, the dealer will issue you a temporary tag to give them time to process the title. Once the title has been processed, you will be able to come in and purchase your tag if the dealer did not do so with your purchase.

Any new resident registering in Forsyth County must have a current emissions before registering vehicles. An annual passing GA emissions test is required prior to renewing or registering your vehicle. For 2022 renewals, 1998-2019 year models, excluding diesels, alternative fuel vehicles and any vehicle weighing more than 8,500 lbs.

Senior Citizens can apply for a waiver of the emissions, if they are over 65 years old and the vehicle is 10 years old or older, and driven less than 5,000 miles annually.

Even more emission information is available on the Georgia's Clean Air Force website.

Forsyth County Tax Commissioner

1092 Tribble Gap Rd.

Cumming, GA 30040

Hours are Monday - Friday 8:30 - 5:00

(770) 781-2110

Sharon Springs Office

1950 Sharon Rd.

Cumming, GA 30041

Hours are Monday - Friday 8:30-5:00

(770) 781-2110

Forms of payment accepted in Office: Cash, Check or Certified

Funds(credit cards are charged a 3% convenience fee)

PLEASE NOTE: THE OWNER OF THE VEHICLE MUST PRESENT A VALID GA

DRIVERS LICENSE

Vehicle Renewal

Renew car tags online, click here.

Vehicle owners must renew their registration and pay the ad valorem tax (if applicable) every year with the Tax Commissioner during the ninety (90) day period which ends on their birthday. If the vehicle is owned by more than one person, then the birthday of the person's name that appears first on the title is used to determine the registration period.

Registrations must be processed in the county where the vehicle

owner resides.

If you need an address change, you are unable to renew online.*

Internet: Be first in line -- every time.

To renew online click here.

Credit cards accepted online are American Express, Discover, MasterCard and Visa.(Credit card convenience fee applied)

A tag cannot be renewed online if the vehicle:

- Does not have a valid Georgia insurance policy, which must be electronically transmitted to the state database by the insurance company

- Requires an emissions test and one has not been completed

- Is covered by a Georgia fleet insurance policy

- Is covered by a Georgia self-insured insurance policy

- Currently has a specialty license plate that requires supporting documentation in order to renew the registration (e.g., military, certified firefighters and amateur radio plates, etc.)

- Registered owner needs an address change.

The vehicle registration must be renewed by the renewal date each year or tax and tag penalties will be assessed.

Renewal by Mail or Drop Box

If renewing by mail, renewal payments should be mailed at least a week prior to the renewal date to allow time for processing. All renewal requirements must be met before the renewal can be processed. If a renewal is submitted without all the required information, it will be returned to the owner and tax/tag penalties will be applied

Payment methods include personal checks, money orders or cash.

An emissions inspection, if applicable, must be completed prior to mailing in your renewal to receive a current year decal.

Renewal payments can be mailed to:

Forsyth County Tax Commissioner

1092 Tribble Gap Rd.

Cumming, GA 30040

Mailed-in renewal payments must be postmarked by the United States Postal Service on or before the renewal date or tax and tag penalties will apply.

Drop box locations:

1092 Tribble Gap Road, Cumming (on side of drive through)

1950 Sharon Road, Cumming, 30041

Checks and money orders should be made payable to "Forsyth County Tax Commissioner."

Forsyth County tag offices cannot accept two-party checks.

Disabled Person's Plate and Placard

Disabled Person's License Plate

To obtain a Disabled Person's license plate, an MV-9D (Disabled Person's Parking Affidavit) must be completed by a

Georgia-licensed healthcare practitioner and be notarized. The licensed healthcare practitioner must designate on the MV-9D form if the disability is temporary or permanent. For a disabled person's license plate to be issued, the disability must be permanent. Bring the completed form along with your Georgia driver's license or Georgia ID Card with a current Forsyth County address to any Forsyth County Tag office. The Disabled Person's license plate cost is $20.00 plus any other fees which apply, including ad valorem or TAVT tax.

Disabled Person's Placard

To obtain a Disabled Person's placard (which hangs from the rear-view mirror), an MV-9D (Disabled Person's Parking Affidavit) must be completed by a Georgia-licensed healthcare practitioner and be notarized or per code section 40-2-74.1, the department shall accept in lieu of an affidavit, a signed and dated prescription from the doctor which includes the same information as required in an affidavit written upon security paper as defined in paragraph (38.5) of Code Section 26-4-5. (Please note: Certification in lieu of affidavit can only be submitted for placards and cannot be provide on license plate applications.) Bring the completed form along with your Georgia driver's license or Georgia ID card with a current Forsyth County address to any Forsyth County tag office. The licensed healthcare practitioner must designate on the form MV-9D whether the disability is temporary or permanent. Temporary permits are issued for six months. To renew a temporary placard, a newly completed form must be submitted. Permanent placards must be replaced every four years and require the submittal of a new MV-9D form which can be completed in our offices.

Return Check Policy (TAGS)

Note: Once a return check has been received, all future

payments will be required to be paid with cash or certified funds.

You will be charged a $30.00 or 5 percent of the face amount of the check, whichever is greater for the returned check fee in addition to the original check amount.

If the restitution on the return check is not paid by the time

allotted it will be turned over to The Magistrate’s Office for the issuance of a

warrant.